VERIZON (VZ): Junior Debt Disguised as Equity

The problem isn't whether Verizon stabilizes — it's what you're left owning if it does.

For: dividend / income-focused investors

Horizon: 3–5 years — not a trade

Data: as of 12/24/2025

The Mismatch

Everyone’s arguing about whether Verizon can stop the wireless bleed.

The real question: what do you own if management actually succeeds? A bigger, more regulated fiber utility whose equity behaves like junior debt — a 6.7% coupon with a 10× P/E ceiling.

The Call

VZ is junior telecom debt disguised as equity — and even the bull case just locks you deeper into utility status with no path to multiple expansion.

You’re earning 250–300bps over Treasuries for levered exposure to a shrinking wireless base and a fiber acquisition that brings regulatory constraints, not growth optionality.

If I wouldn’t buy a BBB-rated 30-year Verizon bond at 6.7%, I have no business owning the equity at the same yield with more risk.

What the Company Actually Does

Verizon is the #2 U.S. wireless carrier by subscribers and a legacy wireline/fiber provider. Revenue runs ~$135B annually, split roughly 70/30 wireless/wireline.

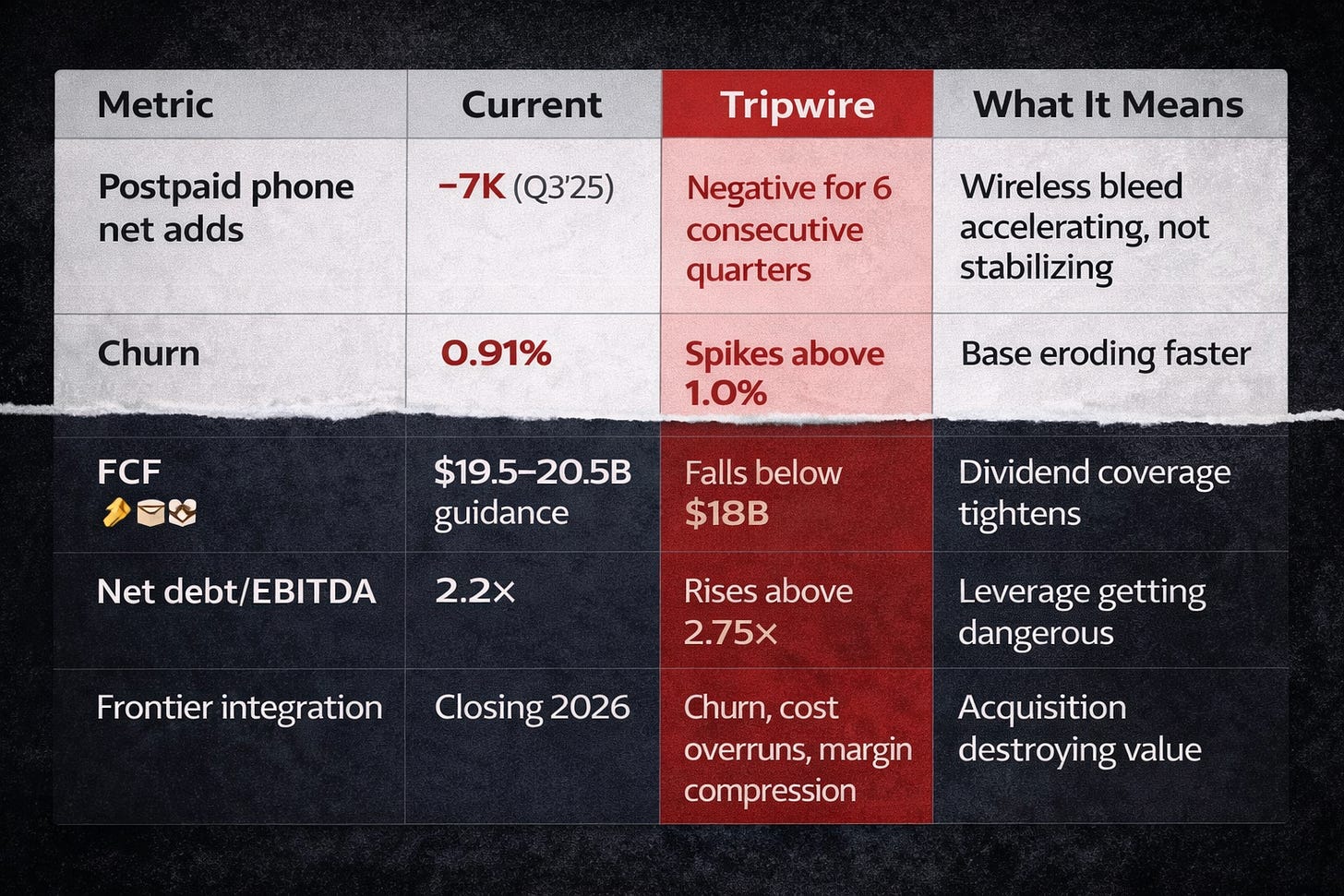

Q3 2025 reality: postpaid phone churn was 0.91%, but VZ posted net postpaid phone losses of 7,000 subs versus +18,000 a year ago. Meanwhile, wireless ARPA rose ~2% YoY. They’re pushing price on a shrinking base. That works for 2–3 years. Long-term, it’s a run-off book. T-Mobile added 850K+ postpaid phones in Q3. The gap isn’t churn — it’s net growth. VZ isn’t losing customers badly; they’re just not winning any.

The Frontier bet: $20B acquisition closing in 2026 adds ~2.2M fiber customers and expands the footprint to ~25M+ homes passed. Management’s pitch is bundling synergies, lower churn, BEAD tailwinds. What they don’t say: California forced VZ to commit to $20/month broadband for low-income users for 10 years as a condition. The more fiber scale VZ adds, the tighter the regulatory straightjacket becomes.

The constraints: $112B net debt at 2.2× net debt/EBITDA. Heavy for a no-growth, high-capex business. Capex guidance is $17.5–18.5B for 2025 — down from $20B peak but still brutal, and Frontier adds more. FCF guidance $19.5–20.5B. Dividend is $11B at ~55% payout, safe unless FCF dips.

Valuation: 8.8× forward P/E, ~5× EV/EBITDA, 7.5% FCF yield. Cheap versus S&P (20×) but in line with AT&T. The multiple isn’t depressed — it’s appropriate for a levered, no-growth, regulated quasi-utility.

What’s Breaking

Nothing is broken if you accept this is a bond. Everything is broken if you think it’s equity.

VZ is trading volume for ARPA — postpaid phone net adds went negative (−7K) while ARPA rose 2%. That defends FCF for 2–3 years, then you run out of base. Frontier success doesn’t unlock optionality. It locks in deeper regulatory capture. California’s $20/month broadband mandate is just the start. Capex has no visible step-down — $17.5–18.5B guidance with Frontier adding fiber capex on top. High-capex, low-growth trap.

The new CEO is cutting 13,000 jobs (13% of workforce) to save $2–3B annually. Cost cuts don’t fix subscriber share losses. You’re cutting costs into a smaller business.

“The more fiber scale VZ adds, the tighter the regulatory straightjacket becomes.”

The Gap (Consensus vs Reality)

Street view: Low-single-digit revenue growth (Frontier helps), flat margins, FCF sustained around $19–20B, modest re-rate to 10× as a stable utility

My view: Even the bull case locks you into utility status. If management executes perfectly — wireless stabilizes, Frontier integrates — you own a bigger, more regulated fiber/wireless bundle whose ceiling is still 10–11× earnings.

The gap: IG corporate credit yields ~5–5.5% with less complexity. You’re earning 150–200bps extra for shrinking-business risk, leverage risk, execution risk, regulatory risk — and a capped upside even if everything works. The spread isn’t adequate.

Where the Returns Came From

Verizon: ~$60 in late 2019 → ~$41 today. Down ~32% in five years.

About 50% of the loss came from multiple compression (P/E went from ~12× to ~8.8×). About 30% came from wireless share losses — T-Mobile ate their lunch while VZ milked the base. About 20% came from capex burden — $17–20B annually with no visible step-down crushed FCF growth.

Here’s the catch: dividends offset some of the damage. Total return was roughly flat to slightly negative over five years if you reinvested the 6–7% yield.

What it means: At 8.8×, you’re paying trough multiple for a business whose best-case outcome is “stable utility at 10× P/E.” That’s a 15% re-rate, not a compounder.

How It Actually Trades (The Machine)

The yield is the floor. 6.7% dividend yield attracts income investors, and as long as the dividend is safe, there’s a bid. The market is pricing in some probability that fiber growth offsets wireless decline through the Frontier deal. Cost cuts could push FCF above $20B if they don’t damage revenue. And if the Fed cuts another 100–150bps and the 10-year drops to 3.5%, VZ’s 6.7% yield compresses versus Treasuries and the stock re-rates on pure math.

The narrative baked into 8.8×: “Milking the base, hoping Frontier works, praying rates drop.” That’s not a growth story — it’s a bond math story. If wireless keeps bleeding and Frontier stumbles, the yield goes to 7.5%+ and the stock drifts toward $35.

How It Handles News

This isn’t a beat/miss stock. It’s yield math and net adds. If the dividend stays safe and rates fall, the tape holds. If wireless keeps bleeding or Frontier drags regulators deeper into the business, the yield reprices — and the stock drops before the headlines catch up.

Wireless net adds matter more than revenue beats. Frontier news moves it — any integration snags, regulatory pushback, or cost overruns hit the stock hard. And VZ is rate-sensitive. Fed rhetoric moves it more than its own quarterly results.

What I’m Watching

Postpaid net adds is the one that matters most. Everything else is noise until wireless stops bleeding.

How It Plays Out

Bull path (6–24 months): Wireless stabilizes with positive net adds for 2–3 quarters. Frontier closes cleanly without integration issues. Cost cuts deliver $2.5–3B savings. Fed cuts rates 100bps+. Stock re-rates to 10× → $46-50. But that’s the ceiling.

Bear path (6–24 months): Postpaid losses persist through 2025. Frontier integration stumbles with churn or regulatory pushback. Rates stay elevated. FCF falls below $18B. Stock drifts to 7–7.5% yield → $35-38.

What It’s Worth (3-5 Years Out)

Valuation walkthrough:

Market cap ~$172B. Enterprise value ~$284B. Net debt $112B. FCF ~$19.5–20B → FCF yield ~11% on EV. That’s bond-like, not equity-like.

Scenarios:

Bear case ($35-38):

Wireless bleeds for another 2 years. Frontier stumbles. FCF falls to $17–18B. Multiple stays 8× or lower. Target: 8× on $4.50 EPS = ~$36

Base case ($46-48):

Wireless stabilizes. Frontier adds modest growth. Utility economics locked in. Multiple re-rates to 10×. Target: 10× on $4.70 EPS = ~$47

Bull case ($52-55):

Everything works. Fed cuts. Regulators stay hands-off. Multiple pushes to 11×. Target: 11× on $5 EPS = ~$55

At $41: You’re paying close to base case. No margin of safety. Total return math gives you ~8–9% annualized (mostly yield, 2–3% price appreciation). That’s S&P-like returns for taking telecom equity risk with a capped upside.

What the Tape Says

At $41, VZ is 10% below its 52-week high of $45 and 13% above the lows.

Momentum is flat to negative. Sitting on long-term support around $40.

This is a “show me” setup — needs proof of wireless stabilization or a clean Frontier close to break above $44. If $40 breaks, next support is $37–38.

Who Owns It and Why It Matters

Income funds, dividend-focused retail, retirees chasing yield. When rates rise or the dividend looks unsafe, these buyers disappear fast. VZ trades like a bond, so it’s rate-sensitive and dividend-coverage-sensitive.

At 6.7% yield, you’re competing with IG corporate credit at 5–5.5%. That 150–200bp spread is supposed to compensate you for shrinking-business risk, leverage risk, execution risk, and regulatory risk. The spread isn’t adequate.

How I’d Actually Build the Position

“If I wouldn’t buy a BBB-rated 30-year Verizon bond at 6.7%, I have no business owning the equity.”

What the setup looks like right now: The yield is attractive (6.7%), but the business is shrinking and the multiple has no upside. This is a bond proxy, not equity.

My sizing: Pass at current levels ($41). The risk/reward doesn’t justify equity exposure when IG credit offers 5–5.5% with less hair.

When I’d get interested: Stock pulls back to $35-38 (yield above 7.2%). Postpaid phone net adds turn positive for 2 consecutive quarters. Frontier closes and fiber subs grow 10%+ in year one.

Scale rule: Only add if wireless stabilization shows up in sustained positive net adds and FCF stays above $19B. One good quarter isn’t enough.

Stop adding if: Postpaid losses persist for 4+ more quarters, Frontier triggers more regulatory constraints than expected, or FCF falls below $18B.

Price Zones (What I Do When)

If I own it:

Buy zone: $35-38 (yield above 7.2%, margin of safety versus IG credit, priced for the bear case)

Hold zone: $38-46 (fair value if you believe stabilization)

Trim zone: $48+ (re-rating plays out, multiple hits utility ceiling)

If I don’t own it:

Entry price: $35-38 only

Pass zone: $41-46 (where we are now — no margin of safety)

Revisit if: Postpaid net adds turn positive for 2+ quarters or stock breaks below $35

What Would Flip Me

Postpaid phone net adds turn positive for 2 consecutive quarters.

Frontier closes cleanly and fiber subs grow 10%+ in year one.

Cost cuts deliver $2.5B+ savings by mid-2026 without revenue damage.

Stock reprices to $35-38 on macro fear without fundamental deterioration.

The Line (Kill Switch)

“The dividend is the only reason to own this. If it cuts, I’m out. No debate.”

Dividend cut or suspension → out immediately

Postpaid phone net adds negative for 6 consecutive quarters → wireless bleed isn’t stabilizing, exit

Net debt/EBITDA above 2.75× for 2+ quarters → leverage getting dangerous, exit

Frontier causes sustained fiber subscriber losses → acquisition destroying value, exit

FCF falls below $18B → dividend coverage tightens, exit

No hopium. No “one more quarter.” These are hard lines.

Bottom Line

VZ at $41 is a pass.

You’re earning 6.7% for levered telecom equity risk with a hard ceiling. IG credit at 5–5.5% looks cleaner with less complexity. The S&P compounds 10–12% with actual growth optionality.

The core problem nobody talks about: Frontier success doesn’t unlock optionality — it locks in utility economics. Even if management executes perfectly, you own a bigger utility at 10× P/E, not a growth story.

Fits: Income investors who can tolerate 2.2× leverage and believe wireless stabilizes. You’re earning ~8–9% total return (mostly yield) if everything works.

Pass if: You can get 5–5.5% in IG corporate credit with less hair, or you want equity exposure with actual growth optionality (T-Mobile is the only telco with real growth).

My move: Watchlist at $35-38. At $41, I’m not taking 8–9% annualized for a stock whose best-case is “bigger utility, same ceiling.”

If this is how you like to think about stocks — filings first, cash over stories, clear kill switches — that’s what I do here every week.

Disclaimer:

This content is for informational and educational purposes only — not financial advice. Do your own due diligence before investing. Nothing here is a recommendation to buy or sell any security.